✨Barnard Investment Group - Newsletter✨

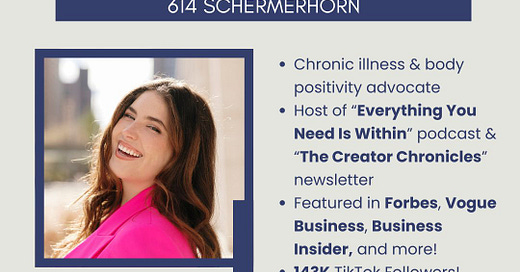

✨ Building Your Personal Brand with Gigi Robinson ✨

Join us for an inspiring event with Gigi Robinson and learn how to elevate your personal brand!

Gigi is a body positivity advocate and host of the “Everything You Need Is Within” podcast. Her work has been featured in Forbes, Vogue Business, Business Insider, and more. With 143k+ TikTok followers, Gigi knows how to make an impact!

📅 Event Details

🗓️ Date: Monday, November 18th, 2024

⏰ Time: 6–7 PM

📍 Location: 614 Schermerhorn

💼 Goldman Sachs Site Visit

Take advantage of this exclusive opportunity to network with professionals across various sectors at Goldman Sachs!

📅 Event Details

🗓️ Date: Friday, December 6th, 2024

⏰ Time: 4:00–5:30 PM (Tentative)

Spots are limited and available on a first-come, first-serve basis, so register now! Sign up here to secure your spot.

We want to hear from you!

Join the Barnard Investment Group General Body! General Body members get access to our Slack and Newsletter and to recruiting prep materials from Wall Street Prep and Mergers & Inquisition and many more professional opportunities! To join the General Body, fill this form and let us know events you are interested in!

Mastercard – Business Analyst Intern, Summer 2025

📍 Location: Purchase, NY

🗓️ Deadline: April 3, 2025, at 6 AM

Join Mastercard's dynamic internship program, where you’ll gain hands-on experience working on impactful technology and business solutions. Collaborate with innovative teams and contribute to initiatives shaping the future of digital payments and inclusive economic growth. This hybrid internship allows in-person engagement while fostering professional development and mentorship.

Insight Partners – 2026 Summer Investment Analyst

📍 Location: New York, NY (On-site)

🗓️ Deadline: May 23, 2025, at 11 PM

Join Insight Partners’ Summer 2026 Internship Program and gain invaluable experience in investment and portfolio management. As a Summer Investment Analyst, you will work with a leading global software investor, partnering with high-growth technology, software, and internet companies driving transformative change in their industries. The 10-week internship offers exposure to software investment strategies, operations, and hands-on support to portfolio companies, including market research, financial analysis, and strategy development.

Citi – Corporate Banking Summer Analyst 2025

📍 Location: New York, NY

🗓️ Deadline: Rolling, positions fill quickly

This prestigious program offers an immersive experience in corporate banking, focusing on capital strategies, client relationship management, and market analysis. Interns work closely with Citi’s Institutional Banking team to deliver innovative solutions and gain exposure to real-world financial challenges. The program includes mentorship, training, and a direct path to potential full-time roles post-graduation.

JPMorgan Chase – Systematic Trading Analyst Intern 2025

📍 Location: New York, NY

🗓️ Deadline: Rolling

Become part of JPMorgan’s Automated Trading Strategies team and play a role in designing and implementing innovative financial market strategies. Interns will work on data-driven projects, creating models and tools that push the boundaries of systematic trading. This program is ideal for students with a strong quantitative background and an interest in financial innovation.

MSG Corp. – Finance Summer 2025 Student Associate Program

📍 Location: New York, NY (On-site)

🗓️ Deadline: December 1, 2024, at 11:59 PM EST

Join Madison Square Garden Entertainment's Student Associate Program, where you’ll gain hands-on experience in the entertainment, sports, and media industries. Interns will collaborate with teams across corporate development, sales operations, performance marketing, and strategic operations. The program includes valuable learning and development opportunities, including an executive speaker series, mentorship, and career development workshops.

🔎 Beijing Warns Trump’s Tariffs Could Disrupt U.S. Defense Sector

President-elect Donald Trump’s proposed tariffs of up to 60% could severely impact U.S. economic growth and disrupt critical supply chains, including the defense sector, warns Ding Yifan, a senior adviser to China’s State Council. At a government briefing, Ding highlighted the U.S.'s heavy reliance on low-cost Chinese parts, citing RTX (formerly Raytheon), which sources from 2,000 Chinese suppliers.

Ding estimates that doubling tariffs could slash U.S. GDP growth by half as manufacturers scramble to replace Chinese intermediate goods. While China would also suffer economic setbacks, Ding emphasized that U.S. consumers would bear the brunt, echoing findings from the Peterson Institute for International Economics.

Chinese President Xi Jinping has maintained a constructive tone, signaling a willingness to cooperate, but escalating trade tensions could lead to “greater chaos” for the U.S. economy, particularly in sectors dependent on intricate global supply chains.

Source: Financial Times

📈 U.S. Inflation Rises to 2.6%, Complicating the Fed’s Next Move

Inflation in the U.S. climbed to 2.6% in October, up from 2.4% the previous month, as the Federal Reserve weighs a possible rate cut at its December meeting. Core inflation, excluding food and energy, held steady at 3.3% annually, with monthly core prices rising 0.3% for the third consecutive month.

With futures markets pricing an 80% chance of a quarter-point rate cut, the Fed faces the challenge of balancing inflation control with economic growth. Chair Jay Powell reiterated that inflation will likely decline gradually but unevenly. However, analysts caution that Trump’s proposed tariffs could reignite inflationary pressures, complicating the Fed’s path toward its 2% target.

Source: Financial Times

✈️ Spirit Airlines Files for Bankruptcy Amid $2.2 Billion Loss

Budget carrier Spirit Airlines has filed for Chapter 11 bankruptcy protection after racking up over $2.2 billion in losses since 2020. The filing follows a blocked merger with JetBlue, rising competition, and engine issues that grounded part of its fleet. Spirit, carrying $9 billion in debt, plans to restructure and emerge from bankruptcy by early 2025.

The airline assured customers that tickets, credits, and loyalty points remain valid. To raise funds, Spirit will pursue compensation for engine defects from Pratt & Whitney and has delayed aircraft deliveries. This marks the first major U.S. airline bankruptcy in over a decade, underscoring the challenges budget carriers face as operational costs soar and competition from “basic economy” fares intensifies.

Source: The New York Times

Join Our Slack Channel!

Stay connected and collaborate with fellow members by joining our Slack channel! It’s a great place to share opportunities, resources, and network with each other. Join here!

Where to Find Us

Instagram: @barnardinvestmentgroup • LinkedIn: Barnard Investment Group • Email: barnardinvestmentgroup@gmail.com